Flux Makes DeFi Easy

DeFi promised to democratize finance. In some ways it has. But for most people, the reality is a maze of protocols, interfaces, and decisions that require near-professional dedication to navigate successfully.

Flux changes who gets to benefit from DeFi's best opportunities.

DeFi Is Harder Than It Should Be

The gap between DeFi's potential and what regular users can actually access is enormous.

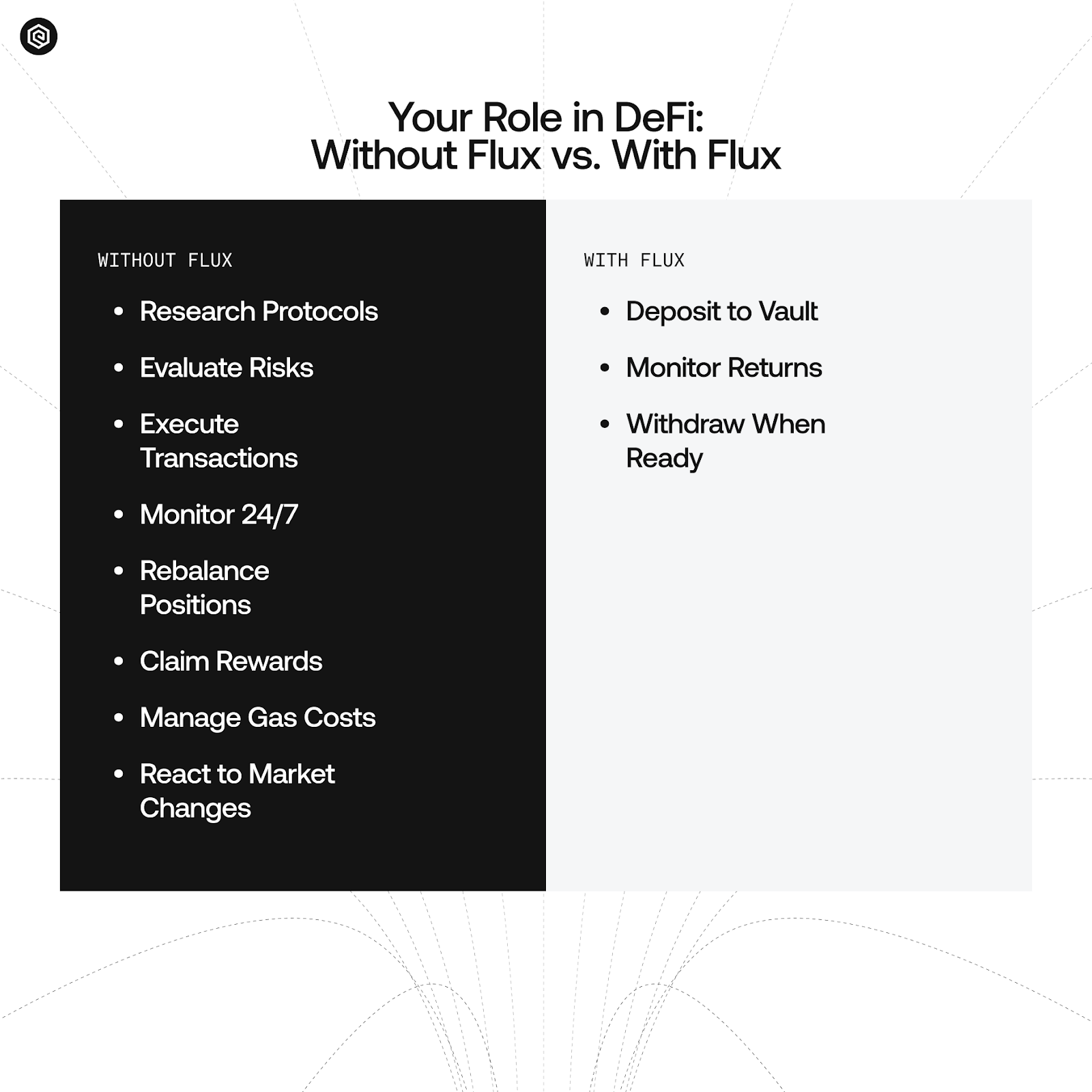

Start with the basics: just choosing where to put your capital requires evaluating dozens of protocols, each with different risk profiles, fee structures, and reward mechanisms. Aave, Compound, Curve, Convex, Pendle, GMX—the list keeps growing. Each one works differently. Each one has its own quirks, risks, and optimal use cases.

Then there's the execution. Moving capital efficiently means understanding gas optimization, timing transactions, and navigating interfaces that assume you already know what you're doing. Bridge to the wrong chain at the wrong time and fees eat your returns. Miss a rebalancing window and your position underperforms. Forget to claim rewards before a deadline and they're gone.

The learning curve is steep and unforgiving. DeFi doesn't have a customer service line. Mistakes are usually irreversible and often expensive.

The Knowledge Gap Is the Real Barrier

Beyond the mechanical complexity, there's a deeper problem: knowing what to do in the first place.

The best yields in DeFi don't come from simple deposits. They come from strategies—combinations of positions across multiple protocols that capture opportunities most users don't even know exist:

- Arbitrage between exchanges

- Leveraged yield farming with hedged exposure

- Liquidity provision in volatile pairs with active management

- Delta-neutral positions that profit regardless of market direction

These strategies require constant attention. Markets shift. Incentives change. A farming opportunity that yielded 40% last month might yield 4% today—or become a liability. Knowing when to enter, when to exit, and when to rotate capital is a full-time job.

Professional traders and dedicated DeFi natives thrive in this environment. They have the tools, the knowledge, and the time to monitor positions around the clock. They understand the risks of each protocol they touch. They can read smart contracts and evaluate whether a new opportunity is legitimate or a trap.

Most people have jobs, families, and lives outside of crypto. They can't spend hours daily tracking yield opportunities across fifteen different chains. They shouldn't have to.

Flux: Expert Strategies, Open Access

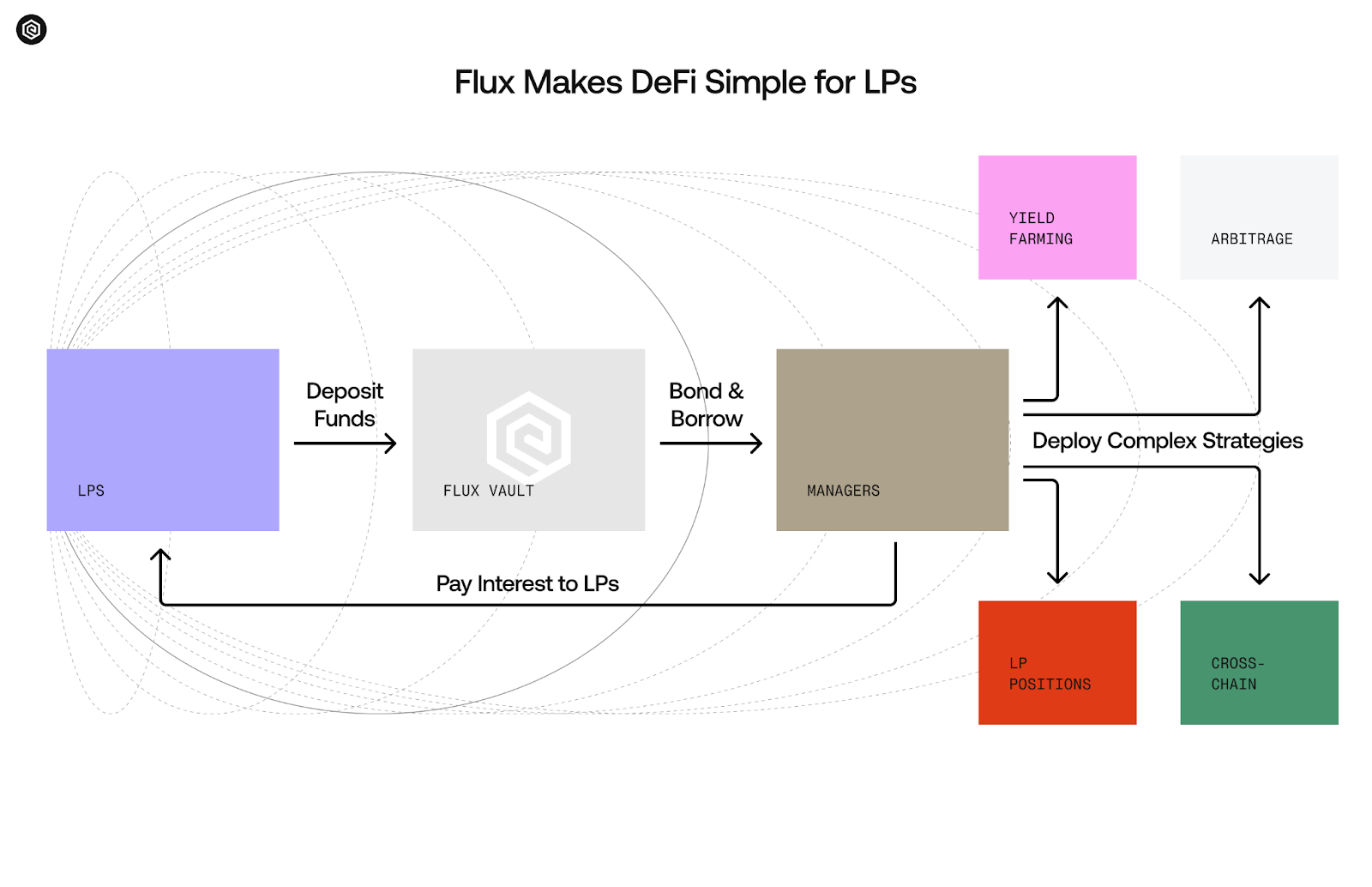

Flux has created a structure where professional managers can deploy sophisticated strategies using pooled capital, while depositors maintain full visibility into every position.

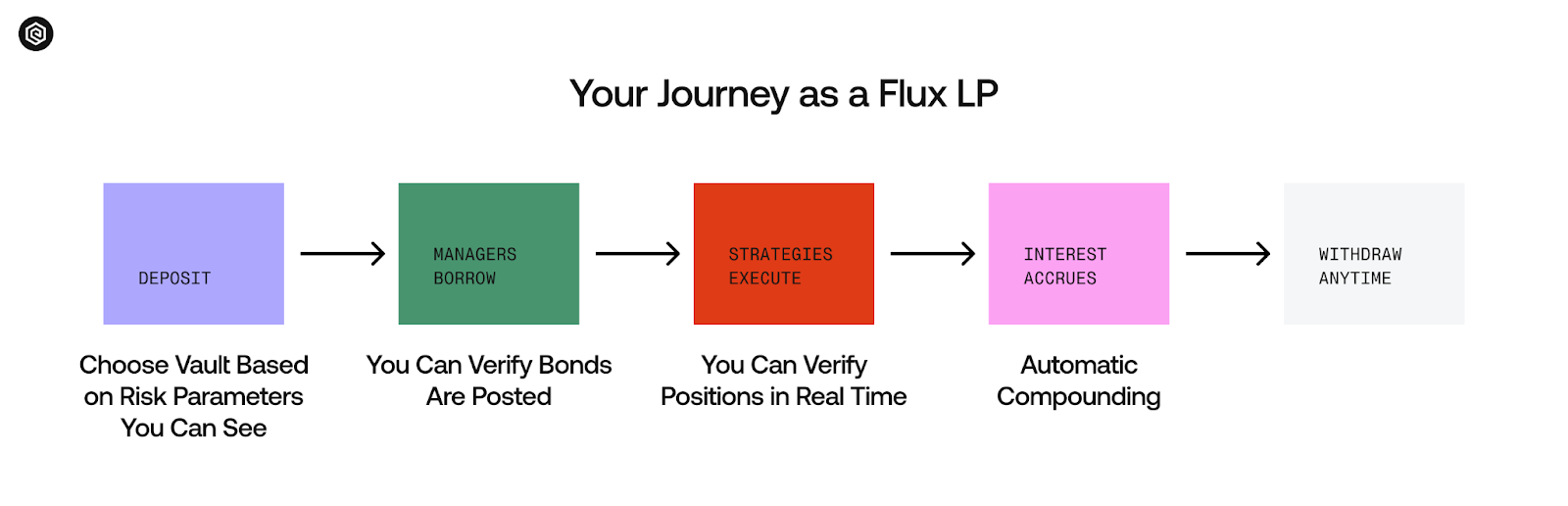

Here's the core idea: you deposit into a Flux vault. Professional managers borrow that capital to execute strategies across DeFi. They pay interest on what they borrow, and that interest flows to you.

The managers handle everything that makes DeFi hard. They identify opportunities. They execute complex, multi-step strategies. They monitor positions and adjust as conditions change. They rotate capital to wherever the best risk-adjusted returns are.

This isn't a black box fund where you hope the managers know what they're doing. Every position is tracked on-chain. You can see exactly where the capital is deployed, how healthy each manager's position is, and what strategies are being executed. The complexity happens on the manager's side; you see the results.

Proof of Yield: Accountability Built Into the Architecture

Access to expert managers is only valuable if those managers are actually accountable. This is where Flux differs fundamentally from trust-based alternatives.

Every manager must post a bond—their own capital—before they can borrow from a vault. This bond is their stake in the outcome. If their strategy fails or their position becomes unhealthy, their bond gets liquidated first to cover any shortfall.

This creates alignment you can verify, not just trust. Managers don't just claim to be good at what they do—they back it with real money. If they're wrong, they pay the price before you do. The bond absorbs losses first, though extreme scenarios can still affect depositors.

The system monitors positions continuously. Health checks happen on-chain, in real time, based on actual asset values. There's no delay for governance votes or manual intervention. If a position crosses into unsafe territory, liquidation happens automatically.

You can query any manager's position at any time. Check their bond health. Verify the assets they're holding. See their track record. The information isn't filtered through a monthly report or a marketing dashboard—it's the raw state of the blockchain.

This is what Proof of Yield means in practice: managers must prove their positions are solvent, continuously, with their own capital at risk. The yield you earn traces to specific sources you can verify. No mystery about where your capital is or whether positions are healthy.

What Expert Managers Can Do That You Can't

The strategies available through Flux go far beyond what's practical for individual users.

Managers can execute complex multi-step operations in single transactions: borrowing capital, swapping across multiple venues, deploying to yield protocols, and establishing hedges.

They can work across chains, deploying capital wherever opportunities are strongest without the friction of manual bridging and the gas costs of moving assets yourself. The vault maintains unified accounting regardless of where the underlying positions live.

They can access opportunities that require significant capital to be worthwhile. Some strategies have fixed costs that only make sense at scale. Some markets have minimum position sizes. Some arbitrage opportunities are only profitable if you can move enough capital to capture them before they disappear.

They can respond to market conditions in real time. When a new farming opportunity opens, they can evaluate and deploy quickly. When conditions change, they can rotate. They're not locked into a single strategy—they adapt.

All of this happens while you hold a simple vault share that appreciates as interest accrues.

DeFi Expertise, Accessible to Everyone

The core promise of Flux is simple: you shouldn't need to become a DeFi expert to benefit from DeFi's best opportunities.

The knowledge, tools, and constant attention required to navigate this space effectively are real barriers. Most people will never have the time or inclination to develop professional-grade skills in yield optimization. That's fine. That's normal.

Flux creates a bridge between people who have capital and people who have expertise. Managers get access to liquidity they can deploy into sophisticated strategies. Depositors get access to returns that would otherwise be out of reach. Everyone operates under transparent, verifiable rules enforced by the protocol itself.

Proof of Yield ensures this isn't just another trust-me arrangement. Manager accountability is architectural, not aspirational. Their capital is at risk alongside yours, and you can verify it at any time.

Don’t trust. Prove.